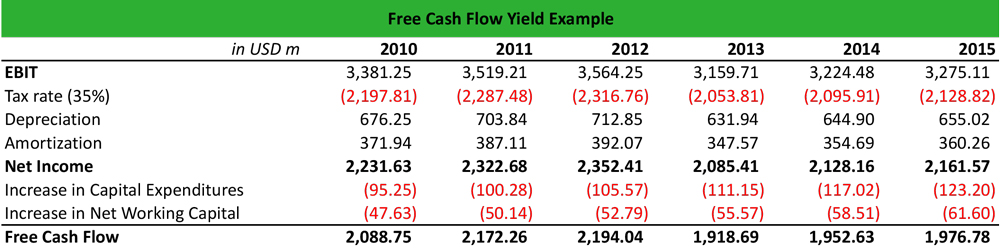

Free Cash Flow Yield Explained. It is the amount of money or transaction balance available to a company after satisfying all financial obligations. The free cash flow yield measures the amount of cash generated from the core operations of a company relative to its valuation.

Free cash flow is very close to warren buffett's definition of owner's earnings, except that in warren buffett's owner's earnings, the spending for property, plant, and equipment is only for maintenance (replacement), while in the free cash flow calculation, the cost of new property, plant, and equipment due to business expansion is also deducted. Analysts may have to do additional or slightly altered calculations depending on the data at their disposal. It is the amount of money or transaction balance available to a company after satisfying all financial obligations.

We can also compare the fcf yields to bond yields.

To define what levered free cash flow is, it is simply the amount of cash available for either (a) redistribution to shareholders, or (b) to reinvest back into the business. The ratio is calculated by taking. The ratio of free cash flow to a company’s enterprise value (fcf/enterprise value). Free cash flow yield explained.